Handpan Insurance (Cost, Examples & Recommendations)

Many of our instruments may cost great sums of money and accidents can happen, either at our own hand, or worse, and someone else’s, This is a guide to musical instrument insurance, rates, expectations and what to insure.

How much does it cost to insure a handpan? – For worldwide cover, against loss, theft, fire and accidental damage it will cost around $150 per year in the US for a $4000 handpan, but only £33 in the UK and Europe for a £3000 handpan. Handpan insurance is inexpensive when considering the cost of your instrument.

This guide will show you how to insure your handpan against theft, accidents, travel, and shipping if you want to send it for a retune, or you have sold it. Prices are updated regularly.

Handpan Insurance in Depth

There are several sections below covering a range of ways to insure your handpan including

- Dedicated Instrument Insurance

- Instrument Insurance

- Travel Insurance

- Shipping Insurance

Often, if you have household insurance, items within the house will be covered up to a particular value. It is worth finding out of your handpan, and its specific value needs to be listed as a separate item. This insurance will not cover your handpan if you are traveling, or if you have sent your handpan to a maker via a shipping method to be retuned, so other types of insurance will need to be considered.

Dedicated Musical Instrument Insurance

Insuring your handpan directly is the recommended way to get cover. The benefits far outweigh other options like household insurance or travel insurance which will have limitations as your instrument is only part of the total coverage.

You should look for dedicated musical instrument insurance that will cover not only the instrument itself but also, accessories and associated gear. You may be traveling and performing, so you will want coverage for all other items such as bespoke handpan cases, which do not come cheap.

If you have amplification gear too, microphones, amplifiers, speakers, mixers and more, these would also potentially need repairing or replacing, so your handpan insurance should extend beyond the instrument itself.

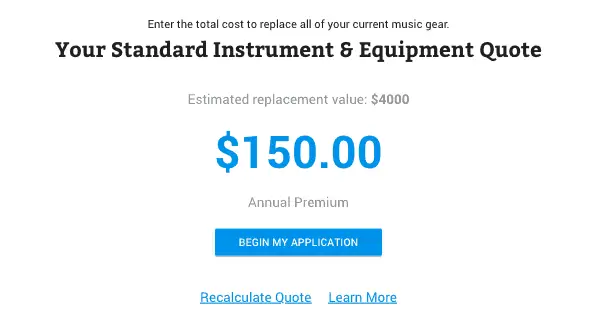

US Handpan Insurance Example

MusicPro Insurance offered worldwide cover for a $4000 handpan for $150 per year.

The coverage was for fire, theft, vandalism, Accidental breakage, Water and flood damage and earthquake damage too.

This cover did, in fact, cover up to a total value of $10,000 for items on an itemized list. So you could have a couple of handpans, covered along with any accessories, such as bags, microphones and amplification gear too.

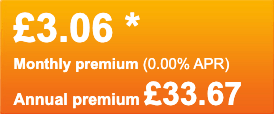

European Handpan Insurance Example

I checked out Allianz who claim to be ‘The Leading Specialist Musical Instrument Insurer‘

Certainly insuring your handpan and associated equipment would seem to be a great deal cheaper in the UK and Europe than in the US as you can see from the quote I received below. [In fact, this is the very insurance I have]

How much to insure a handpan in the UK? – Insurance of a handpan up to the value of £3000 in the UK for worldwide cover including unattended vehicle would cost around £33 for 12 months

The online quote system was really easy to find out how much it would cost to insure my handpan to a value of £3000. It literally took two minutes to complete the online form and get my quote.

Annual Premium of £33.67 for worldwide insurance cover for your handpan including in an unattended vehicle.

Allianz Insurance – December 2019

The cover above also includes, loss, theft, fire & accidental damage. Unlimited professional use, and £500 accessory cover for items valued between £10-£250 each.

For an extra £3, you could add personal liability insurance up to £1m and £10k personal accident too.

| Cover Includes | They Will |

| Accidental Damage | Pay the cost of repairs, or pay to replace the item if it is beyond economic repair |

| Loss or Theft | Pay the cost to replace the item |

| Hire of a replacement instrument | Pay the cost of hire following a valid claim |

| Reduction in value following repair | Pay the amount the value of the item has been reduced by |

How good are the insurers above?

Price is only part of insurance, the real value is when you have to make a claim of course. How quickly your claim is dealt with and if the end result is satisfactory or not is far more important than saving $10 from the start.

I’ve never had to make a claim on my insurance previously so I cannot vouch for that procedure, but what I do consider is finding a cheaper insurer just to save $10 could cost a lot more in the long run. So whilst the insurance cost should be both reasonable and affordable, try not to cut any corners to save a few pennies at the start.

What does Homeowner Insurance Cover for my Handpan?

Home insurance often referred to as home and contents insurance will cover contents and possessions. Most of the time this will include a maximum value for single items. Depending on the details of the policy, this can cover accidents within the home and therefore repair. It may also cover theft should you be unfortunate enough to be burgled.

So homeowner insurance is enough – right?

The maximum value for a single item may not cover the cost of replacing your handpan with new, should the worst happen, so it is worth checking out your policy for the exact details.

If the coverage is insufficient to replace your handpan, you should consider getting it listed separately as an item. This may bump up the price of your policy slightly.

If you have more than one handpan, and more musical instruments, it might be worth looking at separate cover entirely. Especially if you travel with them for pleasure or performance and particularly for the latter.

Separate musical instrument insurance can be very reasonable and provide you with extra peace of mind that if accidents or worse were to happen, you would be able to replace your instruments at no further cost.

An additional 10% of the value of your handpan for bespoke insurance leaves you safe in the knowledge that while it would be a wrench to have anything happen, there would be no additional cost in replacement.

Does Travel Insurance Cover my Handpan?

Travel insurance is quite inexpensive these days and in many cases will cover items you are traveling with, such as luggage. Your handpan would be considered luggage for insurance purposes.

Like household insurance above there will be a limit, depending on the policy you buy, the value of a single item claim. It is important to understand what that limit is and if it would cover the cost of repair of accidental damage or worse, theft.

If you are unsure, contact your insurer and find out exactly what is covered and if you can add specific insurance for your handpan and the cost os replacement should the unthinkable occur.

Individual musical instrument insurance policies are available that cover all of your instruments with each being listed with a specific value. If you have more than one handpan or other musical instruments you re traveling with, either by road, rail or air, then I would highly recommend this separate cover for total peace of mind.

Shipping Insurance

One insurance that is not accounted for often is the cost of shipping insurance. Any courier will offer insurance on any items they handle, whether you are sending it to a maker to be retuned, or if you have sold your instrument and are sending it to the buyer.

How Much does Shipping Insurance cost for a handpan? – ‘Declared value for Carriage’ shipping insurance is very cheap at around 1% of the declared value with a minimum cost of around $10. So for a $4000 handpan, you would pay $10 shipping insurance on top of the carriage cost.

Does the Courier not already have insurance?

In most cases, shipping companies will provide liability for loss or damage but it will be limited to the type of package and location and there will be a ceiling value. If your handpan exceeds this, and it almost always will, you will need to used Declared Value for Carriage insurance to ensure the full cost of repair or replacement is covered.

When Would You use Shipping Insurance?

When selling a handpan, usually the buyer will be requested to pay for shipping and insurance, and it would be helpful to be able to provide potential purchasers of the total cost.

The cost of shipping insurance will be on a standard rate but then fluctuate based on the value of the item being shipped. Often a percentage of the value of the item will be added if over a predetermined amount.

Shipping insurance for your handpan will cover you for any accidents or damage in transit, or again if the worst were to happen and the handpan went missing en route.